$51 Billion in Property Tax Relief? How the Texas Budget Betrays Fiscal Conservatism

April 14, 2025 | Vance Ginn

“This week, I helped pass the most conservative Texas House budget in history.”

Texas Republican Rep. Jared Patterson posted that message after the Republican-led Texas House recently passed its 2026–27 budget version CSSB 1. He and other Republicans also claimed they provided $51 billion in property tax relief, billions for border security, and a massive $28.5 billion left in the Rainy Day Fund as proof of “conservative” leadership. But if this is what passes for fiscal conservatism in Texas, then California-style budgeting has officially arrived in the Lone Star State. Texans aren’t seeing relief—they’re seeing rising tax bills.

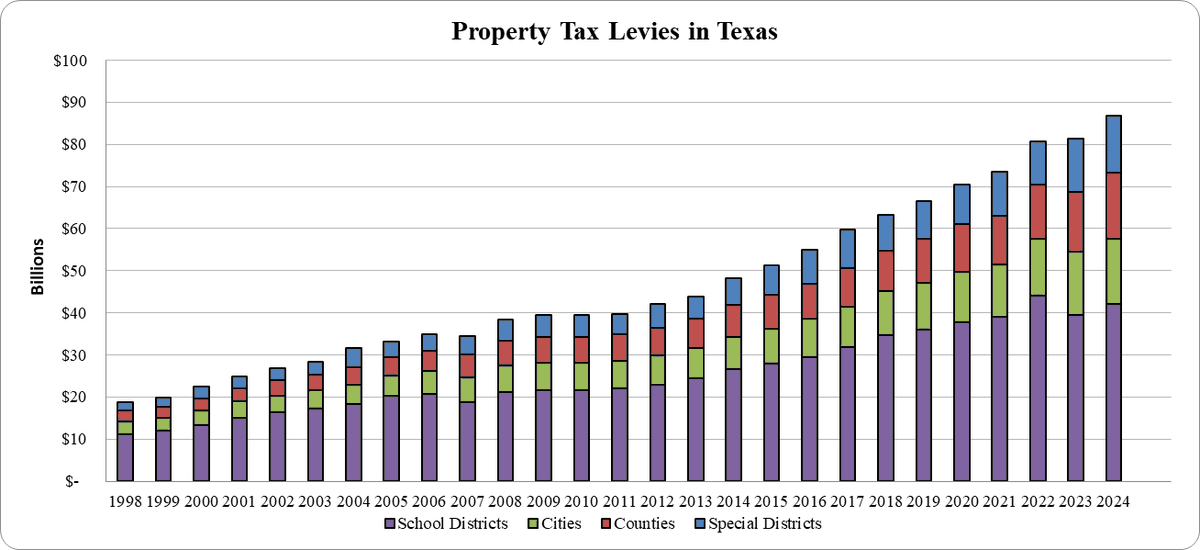

Preliminary 2024 data show that property taxes are going up again.

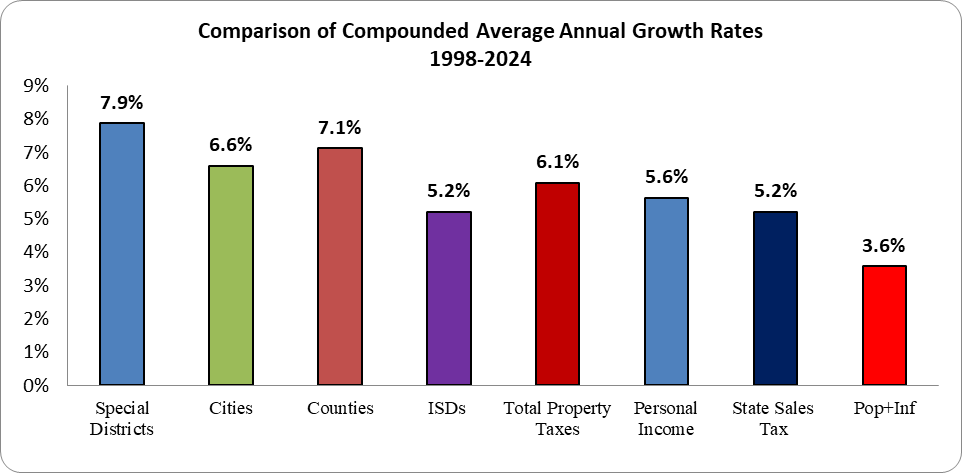

And here’s the kicker: Since 1998, property taxes in Texas have only declined once—back in 2007. And most have grown faster than personal income and much faster than population growth plus inflation.

So, if $51 billion in relief was really delivered, why are families and businesses still drowning in rising property tax bills?

Because the number is wildly misleading.

Let’s break it down. The $51 billion figure cited in the House’s recommended budget back in February covers every dollar allocated to property tax relief since 2019, spanning four budget cycles: 2020–21 through 2026–27. Over that period, Texas will have appropriated roughly $1.16 trillion in total funds. That means this “record tax relief” equals just 4.4% of overall appropriations—while the other 95.6%, or $1.1 trillion, went to growing government.

And of the $51 billion, only $3.5 billion is truly new property tax relief that requires legislation this session. Another $3 billion was already baked into current law, passed under HB 3 in 2019, and would happen automatically unless the Legislature deliberately chooses not to fund it. So at most, only $3.5 billion of new relief is at stake—barely a drop in the bucket compared to the more than $24 billion in overcollected taxpayer money (the “surplus”) and the $28.5 billion sitting in the Rainy Day Fund.

So yes, Texans are right to feel cheated.

This budget was a missed opportunity to finally put school district M&O property taxes—the largest portion of property tax bills—on a path to elimination. Instead, lawmakers protected the status quo, hiked spending nearly across the board, and locked in bigger government for years.

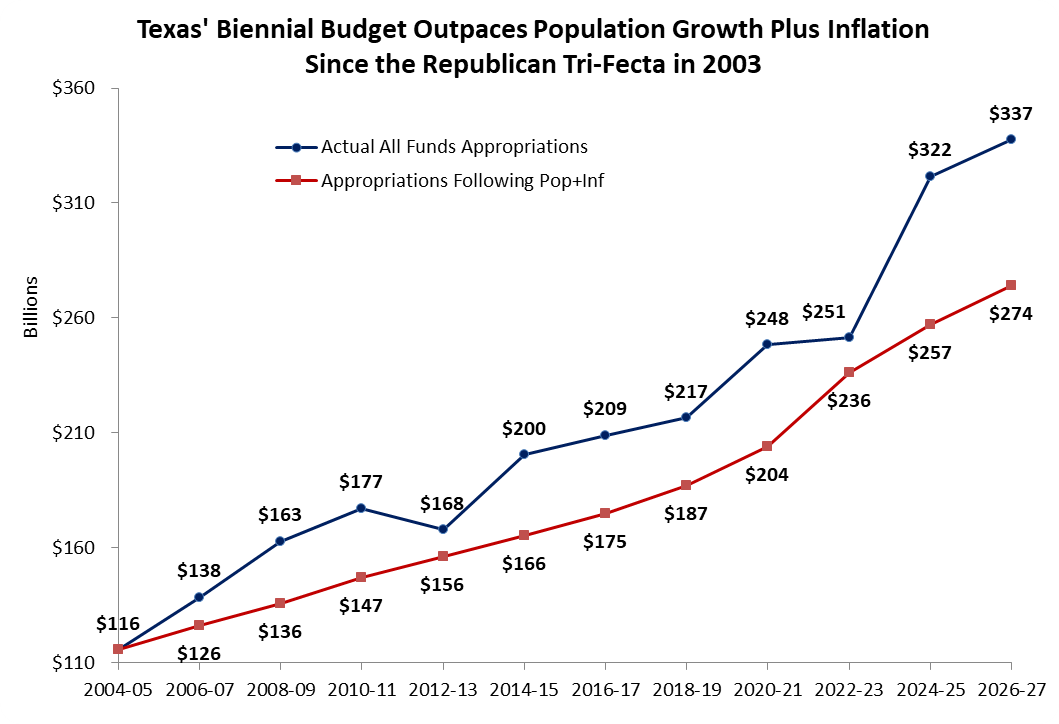

Just look at the numbers since the 2022-23 budget:

- State funds (excluding federal funds) are up 42.8%.

- All funds (state and federal funds) are up 27.4%.

- Even general revenue appropriations—what lawmakers say they directly control but really control all the budget—are up 29%.

- Meanwhile, population growth plus inflation is up just 20%.

That means Texas’ total government appropriations are growing twice as fast as the average taxpayer’s ability to pay for it. And yet the Legislature wants credit for staying under a constitutional spending cap based on personal income growth, though often decided as population growth times inflation, not affordability. It’s a smokescreen.

Worse, these inflated budgets create new spending baselines that will be politically difficult to reverse in future sessions. The only way to shrink government later is through a fiscal crisis—which Texans shouldn’t have to wait for.

While some Republican House members raised concerns about this explosive growth, only 19 voted against the final budget—joined by 7 Democrats who opposed it not for spending too much but for including school choice and not spending even more elsewhere.

In other words, only a small minority of lawmakers are holding the line against big government. The rest are either expanding it or finding new ways to rebrand it.

Take the $6.5 billion set aside for border security. Securing the border is essential, but these taxpayer dollars are spent without meaningful performance audits or accountability metrics. That’s not leadership—it’s bureaucracy, and it mirrors the kind of unchecked, pork-filled spending we often criticize in Washington and Sacramento.

Then there’s the $2.1 billion appropriation to pay down pension liabilities, which lawmakers say will save $11 billion in interest. That’s helpful—but without transitioning to defined-contribution retirement plans or real pension reform, it’s just another Band-Aid on a bleeding system.

Meanwhile, Texans are told that raising the homestead exemption is helping them. But the truth is it just shifts the burden onto renters, small businesses, property owners without a homestead, and everyone through more sales taxes to fund government schooling, while doing nothing to curb local government spending or close loopholes in the property tax system. It’s a political talking point—not a solution.

Here’s the path forward:

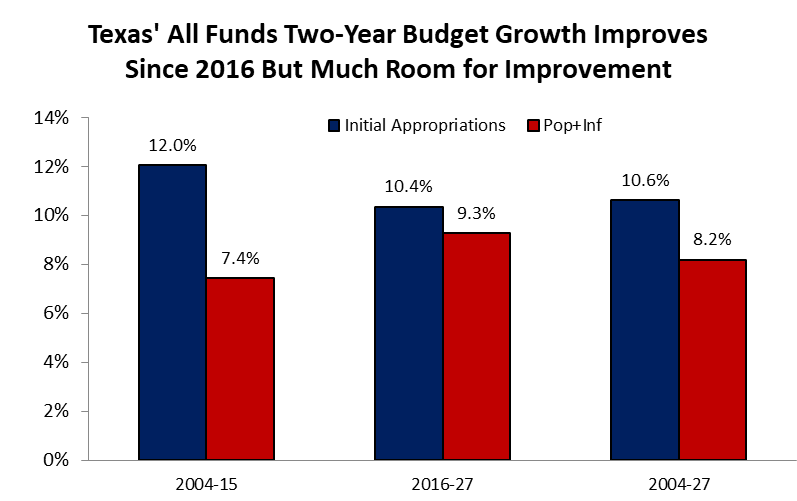

- Cap all state funds spending growth to the three-year average of population growth plus inflation, not income growth.

- Require a two-thirds vote in both chambers to exceed this limit.

- Apply these limits to local governments, where most property tax increases occur.

- Use surpluses to eliminate school M&O property taxes, not temporarily compress rates.

- Stop raising the homestead exemption and end policies that merely shift the tax burden.

- Close rollback rate loopholes that allow local governments to raise taxes without voter approval.

- Replace the broken school finance system with universal education savings accounts, which would improve outcomes and reduce costs.

Texans want to own their homes—not rent them from the government forever. They want a government that lives within its means, just like they do. And they want honesty—not headlines—from their elected officials.

This budget doesn’t reflect any of that. It’s a bloated, big-government plan masquerading as conservative reform. It rewards bureaucracy, ignores the will of taxpayers, and kicks the can on real reform.

If we continue down this path, Texas won’t just resemble California—we’ll become it.

Let’s stop feeding big government—and finally start letting people prosper.

Texans for Fiscal Responsibility relies on the support of private donors across the Lone Star State in order to promote fiscal responsibility and pro-taxpayer government in Texas. Please consider supporting our efforts! Thank you!

Get The Fiscal Note, our free weekly roll-up on all the current events that could impact your wallet. Subscribe today!